Breakthrough in

e-invoicing in Germany

E-Invoicing Government E-Invoicing in Germany

On February 21, 2024, the mediation committee of the German parliament took important steps to introduce the Growth Opportunities Act, a key piece of legislation that allows to change the issue of e-invoicing in Germany.

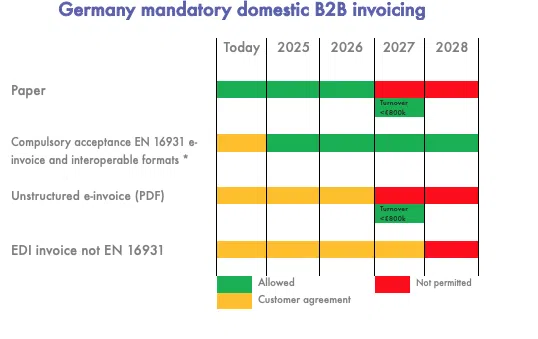

On 22 March 2024, the German Bundesrat (Federal Council) approved a law on the gradual implementation of the obligation to use e-invoices for domestic B2B transactions (gradual implementation is planned for 2025–2028) – the diagram below comes from the explanatory memorandum to the act.

The law has already been approved by the Bundestag. However, the legislative process will only be completed after it has been signed by the Chancellor and the President, and then announced – which has not yet happened.

However, the government's draft law does not currently provide for the German e-invoicing system to include digital reporting, as referred to in ViDA (reporting to tax authorities before or after the invoice is issued). The draft only includes an order to use structured electronic invoicing between enterprises. Existing German standardsXRechnungand ZUGFeRD, in accordance with the justification for the bill, will be continued.

The draft law (awaiting final signatures and announcement) implementing e-invoicing in Germany assumes that:

- From 1 January 2025, the acceptance of electronic invoices will become mandatory, which means significant digitization.

- electronic invoices will comply with EN 16931

- by January 1, 2027, all German companies with an annual turnover of more than EUR 800,000 will be required to use e-invoicing for domestic B2B transactions.

- from 1 January 2028, the obligation to use electronic invoices will be extended to all entities based in Germany, regardless of their turnover,

- as regards the exceptions for the use of e-invoices in domestic B2B transactions, supplementary legal acts will be issued (invoices with a value of less than EUR 250, tickets, vinets, parking fees)

- The period from 1.01.2025 to 31.12.2026 will be a transitional period, which means that during this time paper invoices and e-invoices that do not comply with the EN 16931 standard may still appear in circulation